We provide businesses with the funding to reach their goals. Find out how our invoice finance facility aids Prolog Fulfilment in the journey to net zero.

We provide businesses with the funding to reach their goals. Find out how our invoice finance facility aids Prolog Fulfilment in the journey to net zero.

Discover how our bespoke finance solutions provided Killingley, a commercial landscape contractor, the necessary cash flow when the Covid-19 pandemic hit.

Find out how our Invoice FInance facility helped with the acquirement of Bar Code Data Ltd in January 2020 and supported the business cash flow thereafter.

The pandemic posed unseen challenges for Eco-Genics, a dry ice cleaning and production company. Find out how Invoice Finance helped secure the business.

The Rocal Group encountered challenges in 2018, resulting in reduced sales. Find out how our flexible Invoice Finance helped the business stabilise itself.

Covid-19 supply chain issues created challenges for Viva Sanitary. Discover how our Factoring facility with Bad Debt Protection helped with cash flow.

Norwich-based Skipper Recruit is a new business set up during the pandemic. Discover how we helped them with cash flow and liquidity with Invoice Finance.

Discover how our Invoice Finance facility resolved the cash flow management difficulties Livingreen Design was dealing with as a result of the pandemic.

Fluid Science Ltd faced cash flow challenges during the Covid-19 lockdown. Find out how our support helped the company overcome their challenges speedily.

We take care of credit control for APM Resource, allowing the director can focus on the business. Discover how our solutions help this recruitment agency.

Discover how our working capital funding helped Mauveworx, a Dorset-based marketing materials manufacturer, to produce PPE during the Covid-19 pandemic.

Read more about how our Invoice Finance facility helped with the management buy-out of Glen Cleaning as well as providing working capital to the business.

Invoice Finance and the right funding can help businesses to expand globally. Find out how we enabled Insulated Tools Ltd to grow with flexible funding.

Read how we backed our broker’s customer to expand their classic car collection.

We're experienced in building successful partnerships in the transportation industry. Learn more about our long-standing relationship with T&L Leasing.

Find out how our specialist car underwriters worked seamlessly with our broker partner Apollo Capital to help an avid collector invest in a prestige car.

Discover how we worked with Blackburn-based vehicle manufacturer Electra's customer to finance the production of electric waste lorries for City of London.

Find out how our facility helped to finance a £530,000 Edale Label press to increase productivity at Sturdy Print, a specialist UK label manufacturer.

System Six Kitchens were looking to expand the business. Discover how our Asset Finance solution allowed them to upscale production with new machinery.

Harrogate Spring Water found a trusted finance partner in Aldermore. Learn more about the strong partnership we've built with the business over the years.

Planet Granite took the opportunity to diversify their business in 2016. Find out how our Asset Finance helped the business to invest in new machinery.

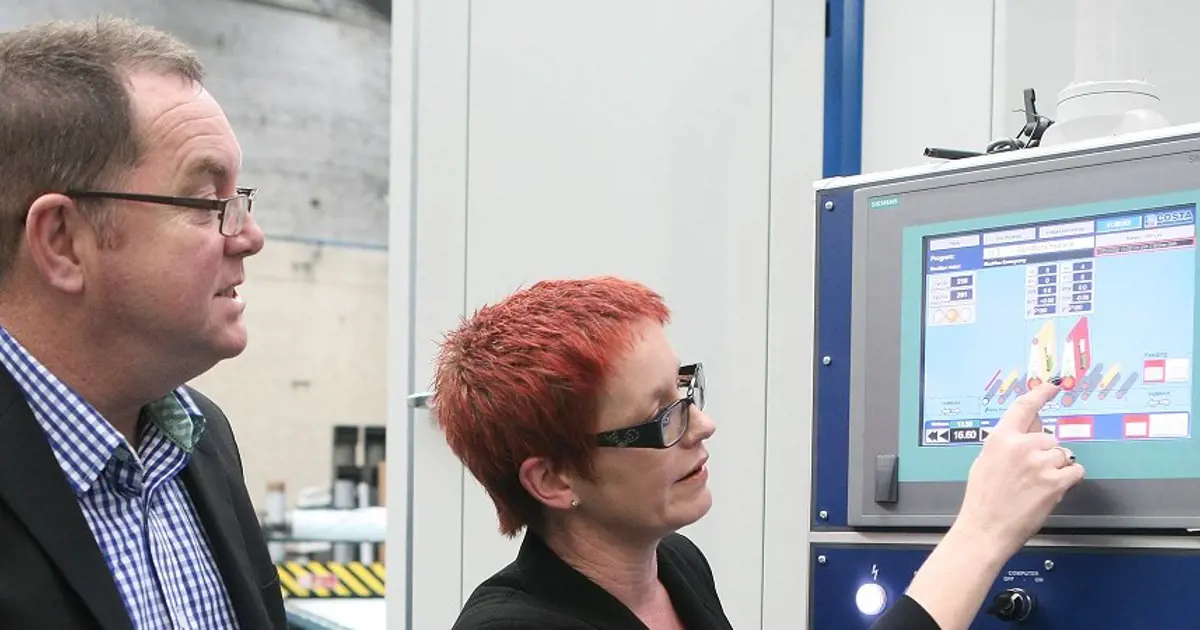

Find out how our flexible finance solution helped to protect cash flow during a time when a market-leading polishing business invested in new machinery.

We provided a property development loan to finance the construction of two luxury residential properties in Hertfordshire.

We work alongside the Housing Growth Partnership (HGP) to fund residential property developments across the UK. Learn more about how we work together.

We provided a £6.1m property development finance loan to Whiteburn for a housing development in Scotland. Find out more about how we helped Whiteburn.

Subject to status. Security may be required. Any property or asset used as security may be at risk if you do not repay any debt secured on it.